Calumet Specialty Products Partners has closed two transactions that together fund the working capital needs of Montana Renewables LLC (MRL), including a supply and offtake agreement with Macquarie Commodities and Global Markets, according to a news release.

The Macquarie supply and offtake agreement provides inventory monetization for renewable feedstocks and products, as well as intermediation services connected with the purchase of renewable feedstocks.

Simultaneously, a $90m asset backed loan revolving credit facility was executed with Wells Fargo Bank, NA, secured by accounts receivables and open blenders tax credit refunds.

“Now that Montana Renewables has commenced operations, these transactions ensure that our working capital needs are met going forward,” said Bruce Fleming, EVP Montana Renewables. “Third party inventory financing has been in the MRL plan since day one, and we are pleased to execute on the plan as we launch operations.”

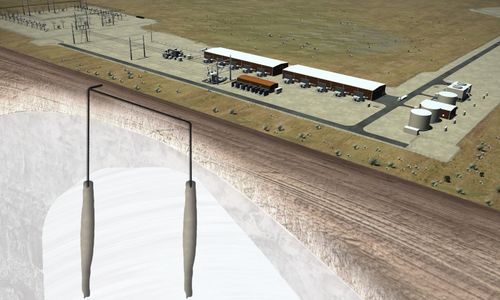

Once fully operational, Montana Renewables, based in Great Falls, Montana, will use waste feedstocks to produce low-emission alternatives that directly replace fossil fuel products including Renewable Hydrogen, Renewable Diesel (RD) and Sustainable Aviation Fuel (SAF).

Montana Renewables is developing a renewable hydrogen facility that will supply hydrogen to the plant’s hydrocracker.

In August, 2022, Warburg Pincus agreed to invest $250m in MRL in the form of a participating preferred equity security, which values MRL at a pre-commissioning enterprise value of $2.25bn. Stonebriar Commercial Finance has invested an additional $350m through a pair of sale and leaseback contracts on top of its existing $50m commitment to MRL. The sale and leaseback transactions carry an approximate 12.3% cost of capital and offer certain strategic early termination options. Concurrent with these transactions, the $300m convertible investment from Oaktree Capital Management L.P. in MRL has been retired.