Copenhagen Infrastructure Partners, through its Energy Transition Fund (CI ETF I), has acquired a majority stake in a blue ammonia project, which will be developed alongside U.S.-based Sustainable Fuels Group (SFG), according to a news release.

The financial terms of the transaction are not disclosed.

The project has entered into an agreement with International-Matex Tank Terminals (IMTT), a terminaling and logistics company, to provide ammonia storage and handling services. Located along the Gulf Coast, the project has commenced detailed engineering (FEED) and will initially consist of two phases, each with a production capacity of 4,000 tons per day (~3.0 million tons of annual production from both phases) once operational in 2027.

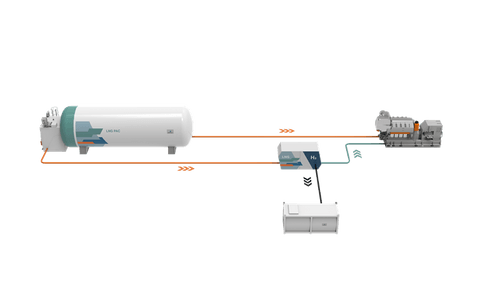

Blue ammonia is a low-carbon approach to ammonia production which combines traditional ammonia synthesis using natural gas with subsequent carbon capture and storage process. The project will use Topsoe’s industry leading SynCOR™ technology to produce blue ammonia with the lowest carbon intensity and is expected to reduce CO2e emissions by 90% (Well-To-Gate) compared to traditional ammonia production, thereby abating 5.0 million tons of CO2 per year.

The project will form part of the CI Energy Transition Fund, which closed in August 2022 at the hard cap of EUR 3.0bn, and like all current CIP Funds, is aligned with the UN Sustainable Development Goals (SDGs) principally through the expected avoidance of greenhouse gas emissions resulting from its investments.

The CI Energy Transition Fund focuses on clean hydrogen, and other next generation renewable technologies to facilitate the decarbonization of hard-to-abate sectors such as agriculture and transportation.

Søren Toftgaard, partner in Copenhagen Infrastructure Partners, said of the acquisition: “We are developing a global portfolio of clean hydrogen and hydrogen-related products, such as clean ammonia. Blue ammonia is considered an important part of a successful energy transition, which can potentially help fill the ammonia shortage in Europe as well as being a steppingstone to the successful implementation of green projects, and we are excited to bring this project to the Gulf Coast region. Further, the agreement provides important diversification to our CI ETF I portfolio and can provide a platform for future hydrogen-related investments in the U.S.”

“IMTT is thrilled to support CIP’s development of this alternative fuels project,” said Chris Partridge, executive vice president of IMTT. “Additional clean energy sources, such as blue ammonia, are vital to advancing the global energy transition. We look forward to leveraging our terminaling experience and expertise to assist CIP in delivering this low-carbon fuel to the market.”