A new report from German management consulting firm Roland Berger proposes a strategic approach to combat climate change by targeting the decarbonization of the world’s 1,000 most carbon-intensive assets.

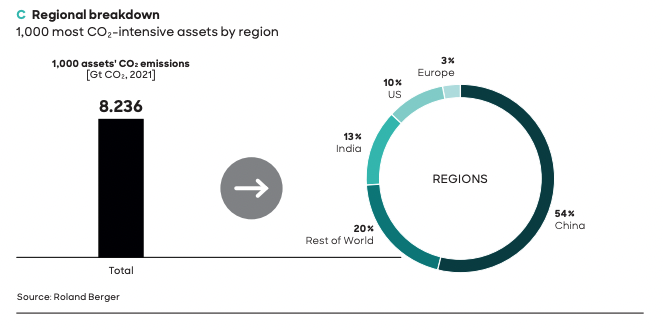

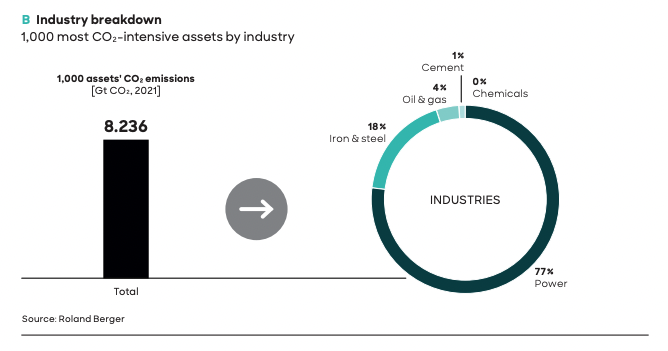

The plan, called the Global Carbon Restructuring Plan, identifies the 1,000 coal-fired power plants, iron, and steel plants that are major contributors to CO2 emissions, noting that over half of these assets are located in China, with significant numbers also in India and the United States.

The ownership of these assets is notably consolidated, with just 40 companies holding assets responsible for half of the noted emissions, suggesting that targeted initiatives could lead to significant environmental benefits, according to the report. Meanwhile, only 160 asset owners together account for around 80% of these emissions.

With a concerted effort to transition these assets towards more sustainable energy sources, including renewable energy, gas, nuclear power, and carbon capture and storage(CCS), the plan outlines a pathway to achieve a substantial reduction in global carbon emissions.

The report calls for widespread deployment of renewable energy in all regions, but notes that each region should “play to its strengths” by complementing renewables with the next best local solution:

- For China and India, this means employing CCS for their high proportion of young coal- and gas-fired power plants.

- In the US, switching from coal- to gas-fired power plants with CCS makes sense due to the low natural gas prices.

- Europe should strive for the deployment of CCS and (re-) consider nuclear as a zero-emission technology that can replace baseload energy supply.

- Like China and India, countries in the RoW cluster should focus on widespread incorporation of CCS for carbon-intensive assets.

According to the study, decarbonizing these key assets could result in a reduction of 8.2 gigatons of CO2 emissions, representing a third of the required reduction to maintain hopes of limiting global warming to 1.5°C. Financially, the decarbonization efforts are estimated to cost between USD 7.5 trillion for renewable energy initiatives and up to USD 10.5 trillion for nuclear and CCS solutions over a 26-year period from 2025 to 2050.

The report points to stark differences in the costs of decarbonization among emitter countries. “Taken as one-off expenses, decarbonizing the top 1,000 assets will cost China 23-32% of its GDP and will cost 18-31% of GDP in India,” according to the report. “For the RoW cluster, it comes to 9-10%, but for Europe and the United States, it works out at just 2-5% of their respective GDPs.”

‘Headroom’

The Global Carbon Restructuring Plan delves into the financial viability of decarbonization technologies, highlighting a concept known as ‘headroom’. Headroom represents the financial capacity of asset owners to invest in decarbonization without reaching unsustainable levels of debt. The plan’s analysis indicates that the 406 asset owners identified possess a collective headroom of approximately USD 2.2 trillion, underscoring the financial potential to support decarbonization efforts significantly.

This financial headroom is unevenly distributed across regions and sectors. Remarkably, almost half of this capacity is held by companies outside of the traditional economic powerhouses, in the rest of the world (RoW), particularly within the oil and gas sector. Chinese companies account for 21% of the total headroom, with US firms close behind at 20%. European companies contribute 9%, while Indian firms represent a mere 3% of the global capacity.

The plan raises a pivotal question: Is this USD 2.2 trillion in headroom sufficient to finance the transition to low-carbon technologies? The answer varies by the type of decarbonization solution. For carbon capture and storage (CCS) and gas, the required capital expenditures (CapEx) of USD 1.2 trillion and USD 1.3 trillion, respectively, fall within the available headroom, suggesting these technologies could be pursued immediately with existing financial resources. However, renewable energy sources (RES) and nuclear power present a more complex financial challenge, each requiring an estimated USD 4 trillion in CapEx—nearly double the available headroom. This indicates that an additional USD 2 trillion in financing, from either public or private sources, would be necessary to fully implement these solutions.

Moreover, the plan underscores that financeability is not solely a function of the technology chosen but also varies significantly by region. While companies in RoW could feasibly finance all four decarbonization solutions, China and India face substantial financial hurdles across the board. In contrast, for Europe and the US, only the shift to 100% nuclear power would encounter significant financial barriers.