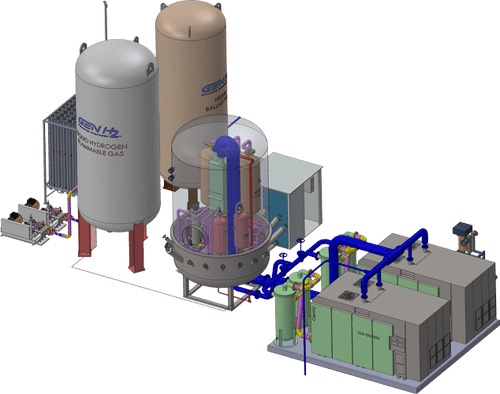

Electric Hydrogen Co., a manufacturer of advanced, industrial-scale hydrogen electrolyzer technology, announced the location of its first factory in Devens, Massachusetts.

The company has leased a newly constructed 187,000 ft2 facility and is now hiring production team members. The Devens factory will have an annual manufacturing capacity of 1.2 GW with production of EH2’s 100 MW green hydrogen electrolyzers commencing in Q1 2024.

“Our company has a single purpose: to make molecules to decarbonize our world,” stated David Eaglesham, EH2’s CTO and co-founder. “Industrial sectors such as fertilizer and steel need new ways to reliably replace fossil resources at costs that work. The machines we will produce at our new factory in Devens will have a transformational impact by enabling ultra-low-cost green hydrogen at an industrial scale.”

Green hydrogen, made by breaking the chemical bonds of water using renewable electricity, is a growth industry that can make an immediate impact on the global climate crisis. Electric Hydrogen expects its technology to establish the standard for industry-wide cost reduction to make green hydrogen cheaper than fossil alternatives.

“There are a lot of factory announcements in our industry, but not a lot of real capacity being built,” said Raffi Garabedian, EH2’s Chief Executive Officer and Co-founder. “We have a backlog of customer orders to fulfill and are moving quickly to build and ship the world’s most powerful electrolyzers.”