Everfuel, the green hydrogen producer based in Denmark, and Hy24, the clean hydrogen infrastructure fund of French private equity firm Ardian, have formed a JV to finance electrolyzer capacity across the Nordics, according to a news release.

The JV will be named Everfuel Hy24 A/S and fully consolidated in Everfuel’s accounts. Everfuel will own 51% of the JV and the Hy24-managed Clean H2 Infra Fund will own 49%.

Plans call for a total equity investment of EUR 200 million in green hydrogen infrastructure in Denmark, Norway, Sweden and Finland. This will enable the JV to fund, build, own and operate up to 1 GW of green hydrogen projects.

The JV combines Everfuel’s position as a green hydrogen project developer in Europe and Hy24’s industrial experience and financial strength. It will further benefit from Everfuel’s pipeline of hydrogen projects as they are matured to final investment decision (FID) and transferred to the JV subject to predefined criteria.

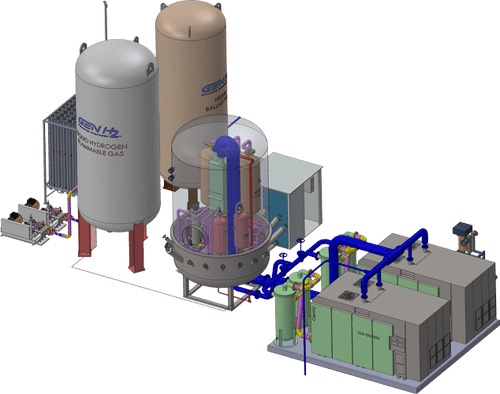

The JV’s first investment is to acquire the HySynergy Phase 1 20 MW green hydrogen production plant in Fredericia, Denmark for a purchase price reflecting the costs incurred at signing, less grants received, subject to adjustment for additional costs incurred up until closing. HySynergy is expected to commence commercial operations in the second quarter of 2023 and will contribute to industrial processes at the adjacent Crossbridge Energy Refinery.

That project will also offer a competitive supply of green hydrogen as zero-emission fuel for clean mobility. In December 2022, HySynergy Phase 2, 300 MW, green hydrogen plant was granted IPCEI funding of EUR 33.1m to support the construction of the first of three 100 MW electrolyzers.

The purchase price paid by the JV to Everfuel for the acquisition of HySynergy Phase 1 is estimated at EUR 28m. With the transfer of HySynergy Phase 1 to the JV, Everfuel will repay the outstanding EUR 10m loan provided by the European Investment Bank. Hy24 will also provide a bridge loan of EUR 15m to JV that is expected to be replaced with a larger facility from external debt providers as HySynergy Phase 2 is matured. Everfuel holds an option to purchase Hy24’s shares in the JV at a pre-agreed return within a specified time period.

Under the agreement, the JV will deliver revenue and cash flow to Everfuel through fees during the project development, construction and operation phases. Everfuel will also be entitled to defined development fees from the JV for projects reaching FID based on the return profile of each specific project. Everfuel retains an exclusive right to market merchant hydrogen volumes from the electrolyzers owned and operated by the JV to support the growth of Everfuel’s downstream business activities.

Denmark is planning to develop 4 GW to 6 GW of electrolyzer production capacity by 2030, leveraging wind resources. Everfuel’s current project portfolio in Denmark includes more than 1.3 GW of electrolyzer capacity.

Following completion of the JV’s establishment, Everfuel is sufficiently funded to support its share of anticipated JV investments, including projects passed through FID, towards the end of 2023. As part of the JV incorporation, Hy24 has committed to participate in a potential future capital raise by Everfuel to support the company and the realization of green infrastructure projects, subject to certain conditions.