NovoHydrogen, the Colorado-based renewable hydrogen developer, will be in the market for project financing for a portfolio of distributed green hydrogen projects in 2024, CEO Matt McMonagle said.

The company, which recently agreed to a $20m capital raise with Modern Energy, is aiming to attract additional private equity and infrastructure investors for the projects it is developing, the executive said.

“The opportunity is really there for attractive risk-adjusted returns at the project level based on how we’re structuring these projects with long-term contracted revenue,” he said.

The company plans to bring its first projects online in late 2024 or 2025.

“We don’t have the project financing set at the point that we can announce, but that’s something myself and my team have done in our careers,” McMonagle said, adding that he’s focused on bankability since founding the company. “We wanted to be as easy for the lenders to underwrite as possible.”

No financial advisors have been attached to the project financings, McMonagle said. A recently announced Series A, first reported by ReSource in February, gave the company exposure to investors that want to participate in project financings, he said.

“We’ll really be ramping that process up, likely after the new year,” McMonagle added, declining to say how much the company would need to raise in 2024.

NovoHydrogen doesn’t have a timeline on a Series B, he said.

Distributed pipeline

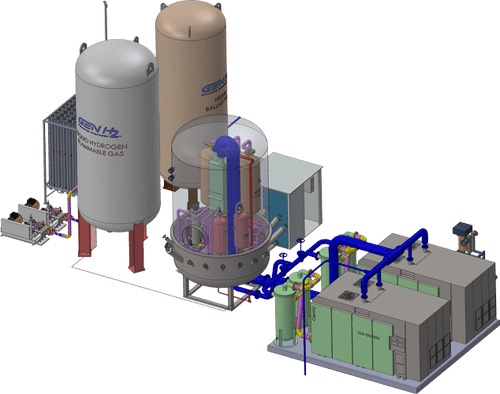

The company looks to do onsite projects adjacent to consumption, McMonagle said. The first projects that will go online will be 10 MW and smaller.

“Typically the permitting is straightforward in that we’re adding equipment to an already impacted industrial site,” McMonagle said. He declined to elaborate on where these projects are located or what customers they will serve.

The company also has off-site, or near-site projects, where production is decoupled from consumption. But the company still calls those distributed because they are being developed with a targeted customer in mind.

“We want to be as close as possible to that customer,” he said. Those off-site projects typically are larger and will begin coming online in 2026 and 2027.

In Texas NovoHydrogen has two large-scale green hydrogen developments in production, co-located with greenfield renewables projects, McMonagle said. Partners, including EPC, are in place for those efforts. The company also has projects in West Virginia, Pennsylvania, New Jersey and along the west coast.

“Where can we add the most value and have the biggest competitive advantage?” McMonagle said of the company’s geographic strategy. “We have very specific go-to-markets in each of those regions which we feel play to our strengths.”

NovoHydrogen is a member of the Pacific Northwest Hydrogen Hub and is involved with the Appalachian Regional Clean Hydrogen Hub (ARCH2), though not in line to receive DOE funding through that hub.

Post-IRA, green hydrogen projects will look much like renewables deals from the equity, tax equity and debt perspectives, he said.

“We’re structuring and setting up our projects to take advantage of that existing infrastructure and knowledge base of how to finance deals,” he said. New options on transferability will enable additional financing options as well.

No flipping

NovoHydrogen does not plan to flip projects before COD, McMonagle said.

“We are planning to deploy hundreds of millions if not billions of dollars in capex for these projects, and we’ll certainly need to partner with folks to deploy that capital,” McMonagle said. “But we will remain in deals with our customers because that relationship is really the fundamental value that we bring in our business.”

Hydrogen projects are different from renewables in that the customers need greater assurances of resiliency, security of supply and performance, than in a space like solar, he said.

Flipping projects before COD would be inconsistent with the trust required to attract offtakers.

“We don’t believe doing a flip reflects that level of importance and support and, frankly, incentive, behavioral incentive, that we have to show to our customers,” he said.