OptiFuel Systems, a provider of zero-emission line haul locomotives and generation solutions, is conducting a $30m Series B capital raise.

The South Carolina-based firm is seeking to finalize the Series B by the end of this year, and plans to use proceeds to advance production of its zero-emission technologies for the rail industry, which represents a massive decarbonization opportunity, CEO Scott Myers said in an interview.

Meanwhile, the firm will seek to tap the market for around $150m for a Series C next year, Myers added. The company is not working with a financial adviser.

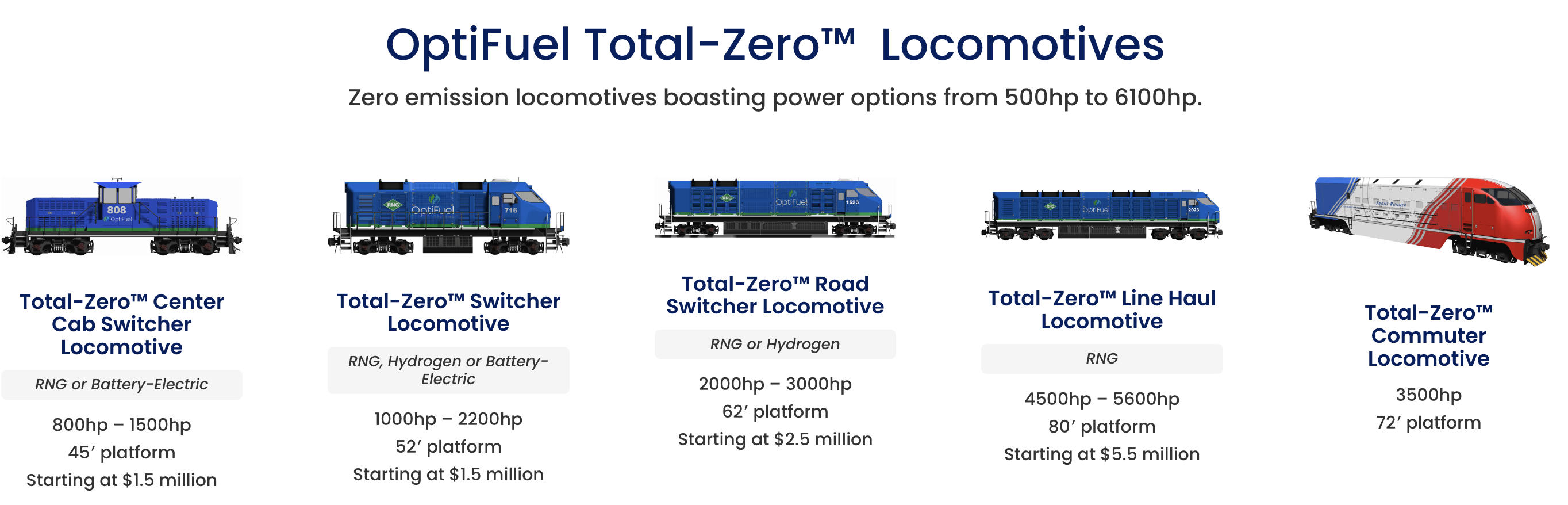

While the Series B will focus on bringing to production some of OptiFuel’s smaller rail offerings, such as the switcher locomotives, the Series C will be mostly dedicated to progressing testing, manufacturing, and commercialization of its larger line haul locomotive.

The company is also considering making its own investments into digesters for RNG facilities, from which it would source the gas to run its RNG-fueled locomotives. As part of its offering, OptiFuel also provides refueling infrastructure, and envisions this aspect of its business to be just as profitable as selling trains.

“We anticipate that we would be the offtaker” of RNG, “and quite potentially, the producer,” Cynthia Heinz, an OptiFuel board member, said in the interview.

A systems integrator, OptiFuel offers modular locomotives for the freight industry that can run on zero-emission technology such as renewable natural gas, batteries, and hydrogen. The company recently announced that it will begin testing of its RNG line haul locomotive, which is a 1-million-mile test program that will take two years and require 10 RNG line haul locomotives.

The company’s target market is the 38,000 operating freight trains in the U.S., 25,000 of which are line haul locomotives run by operators like BASF, Union Pacific, and CSX. Fleet owners will be required to phase out diesel-powered trains starting next decade following passage of in-use locomotive requirements in California, which includes financial penalties for pollution and eventual restrictions on polluting locomotives. Other states are evaluating similar measures.

“The question is not will the railroads change over: they have to,” Myers said. “The question is, how fast?”

Following completion of testing, OptiFuel aims to begin full production of the line haul locomotive – which has a price tag of $5.5m per unit – in 2028, and is aiming to produce 2,000 per year as a starting point. The smaller switcher units are priced between $1.5m and $2.5m depending on horsepower.

OptiFuel has held discussions with Cummins, one of its equipment providers, to source at least 2,000 engines per year from Cummins to support its production goal.

“That’s a $10bn-a-year market for us,” Myers added.