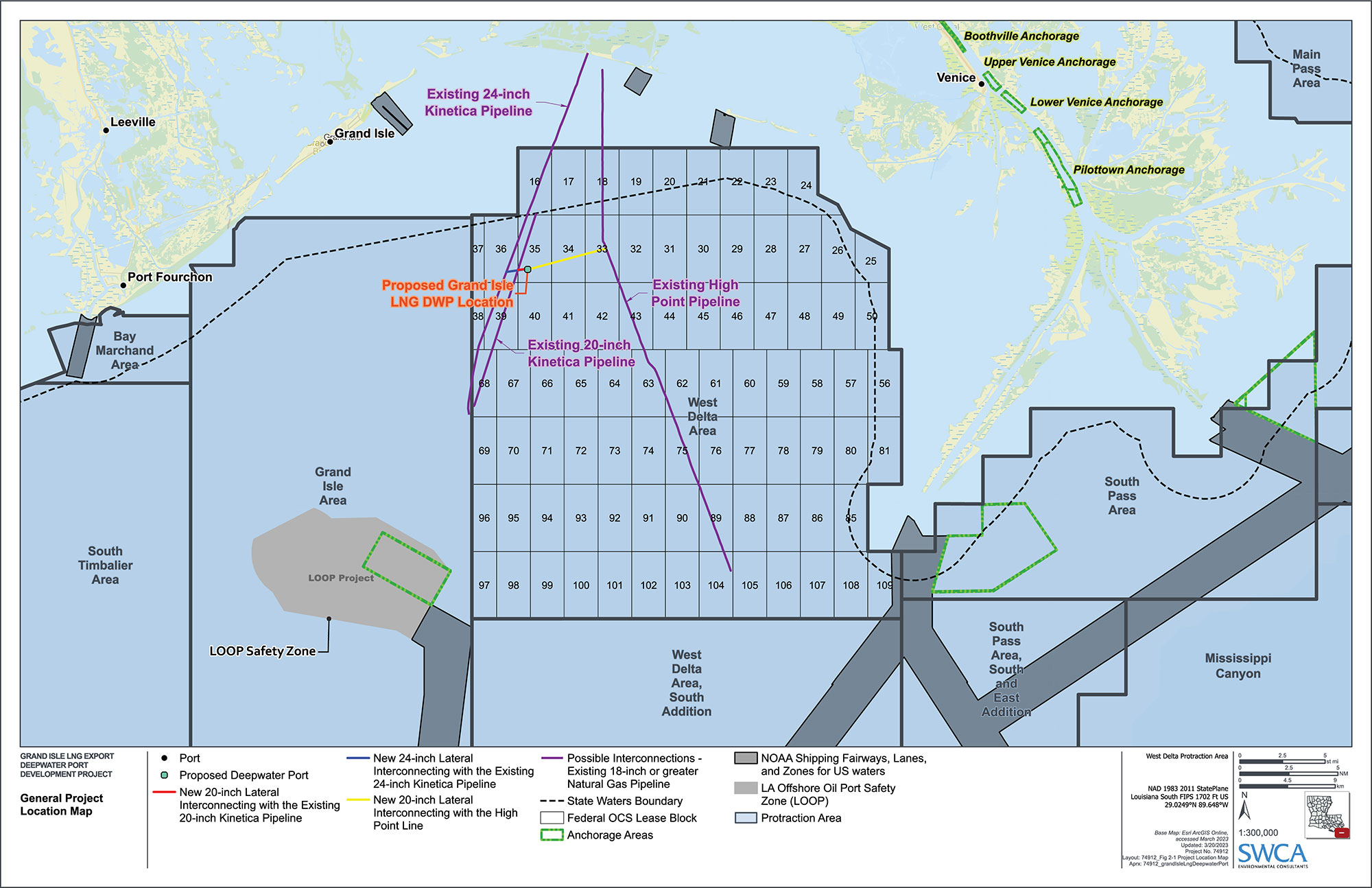

Grand Isle LNG, a proposed LNG liquefaction and export project off the coast of Louisiana, has pulled its application for a deepwater port facility.

The Maritime Administration and the U.S. Coast Guard last week posted a notice saying they have cancelled all actions related to the processing of a license application for the proposed Grand Isle LNG project.

The project, announced last year, proposed to build a crew quarters platform, two gas treatment platforms, two 2.1 million tons per annum-MTPA liquefaction platforms, two loading platforms, one thermal oxidizer platform, and two 155,000 cubic meter storage and offloading vessels, according to a press release.

In the notice, MARAD said that, “The action announced here also includes cancellation of all activities related to the deepwater port application review and preparation of an Environmental Impact Statement that was previously published in the Federal Register on Monday, July 3, 2023. The publication of this notice is in response to the applicant’s decision to withdraw the application.”