Oleo-X, a producer of renewable fuel feedstocks, launched a renewable diesel and sustainable aviation fuel feedstock merchant pretreatment facility.

The company, which is backed by PE firm Time Equities, also announced the appointment of longtime airline fuel executive Sergio Correa as CEO, according to a news release.

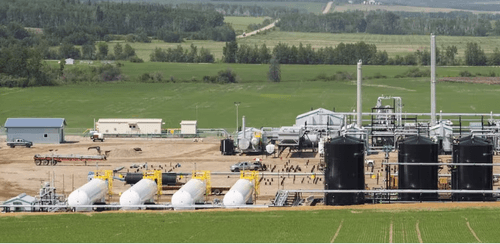

Located in Pascagoula, Mississippi, Oleo-X’s facility has the potential capacity to produce up to 300 million gallons per year of premium feedstock. The company leverages its advanced pretreatment technology to innovate exceptionally clean, high-quality RD and SAF feedstocks, which enable partners to produce premium renewable fuels. Oleo-X’s advanced chemistry formulates an unmatched product that can extend RD and SAF unit catalyst lives by years. The purity of the feed reduces the revamp cost of converting existing conventional refining units to process renewable feedstock, while also lowering carbon intensity.

With its new facility now in operation, Oleo-X is carving out a unique position within the fast-developing renewable energy ecosystem. The company’s innovation is substantially widening the pool of renewable energy feedstocks. Oleo-X’s industry-leading chemistry and plant enable it to process low-carbon, inedible oils – including poultry fat – without blending in high-quality oils taken from the food industry. This achievement is a breakthrough for the RD and SAF industries, marking important progress toward a more sustainable future.

“At Oleo-X, our vision is to feed the growing demand for sustainable energy, and today’s launch brings us one major step closer to making that vision a reality,” said Oleo-X investor Ivonne Ruggles. “Our goal is to be a leader in sustainable energy: We are delivering a product so pure that some customers already call it ‘liquid gold.’ Oleo-X is committed to modernizing and optimizing the way low-carbon fuels are manufactured.”

Oleo-X’s work brings a sustainable, clean energy focus to a facility that previously manufactured chemicals for tires, dyes, and building materials. The company purchased its site, the former home of Chemour’s First Chemical plant, in June 2022. Over the past 11 months, Oleo-X invested substantially to revamp and expand the facility, transforming it into a state-of-the-art leader in the renewable fuels space.

“We are very pleased to support the unparalleled innovation of Oleo-X,” said Francis Greenburger, Chairman & CEO of Time Equities Inc. (TEI), Oleo-X’s majority investor. “At TEI, we target renewable energy and decarbonization investment deals that offer compelling risk/reward profiles, while simultaneously making the planet cleaner and safer. Oleo-X is a perfect alignment of these goals, and we are proud of the positive impact that the company’s work is generating.”

Correa, Oleo-X’s new CEO, brings deep experience in the oil and gas space with long-term perspective from a large end-user. For more than a decade, he has worked at Delta Air Lines, as the head of Clean Oil Products, leading five business functions and overseeing the supply and trading of $10-15 billion in physical oil.

“After gaining extensive experience in the fuel industry, I am proud to deepen my focus on innovative renewables at Oleo-X,” said Correa. “Helping to bridge the gap between our diverse industries such as agriculture, chemicals, oil, and transportation, and with our diverse investor, supplier, and customer base, is a fascinating challenge. I am eager to lead Oleo-X’s journey at the forefront of this fuel revolution.”

The Oleo-X facility supports more than 60 jobs, including 27 site leadership employees in Jackson County. The company is on track to grow throughout the remainder of the year, increasing its workforce, production, and community involvement.

“We are immensely grateful for the dedication and hard work by Oleo-X’s incredible employees and the Jackson County community,” said Greenburger. “We are fortunate to have such a high level of dedication and commitment to our work. We look forward to the continuous momentum of making our vision a reality with our top-quality talent and support.”