The U.S. Department of the Treasury and the Internal Revenue Service (IRS) this week released final rules on tax credit transferability.

The Inflation Reduction Act created two new credit delivery mechanisms—elective pay (otherwise known as “direct pay”) and transferability—that are enabling state, local, and Tribal governments; non-profit organizations; Puerto Rico and other U.S. territories; and many more businesses to take advantage of clean energy tax credits.

Until the Inflation Reduction Act introduced these new credit delivery mechanisms, governments, many types of tax-exempt organizations, and many businesses could not fully benefit from tax credits like those that incentivize clean energy construction, the agencies said in a news release.

“The Inflation Reduction Act’s new tools to access clean energy tax credits are a catalyst for meeting President Biden’s historic economic and climate goals. They are acting as a force multiplier, enabling companies to realize far greater value from incentives to deploy new clean power and manufacture clean energy components,” said Secretary of the Treasury Janet L. Yellen. “More clean energy projects are being built quickly and affordably, and more communities are benefitting from the growth of the clean energy economy.”

The Inflation Reduction Act’s transferability provisions allow businesses to transfer all or a portion of any of 11 clean energy credits to a third-party in exchange for tax-free immediate funds, so that businesses can take advantage of tax incentives if they do not have sufficient tax liability to fully utilize the credits themselves. Entities without sufficient tax liability were previously unable to realize the full value of credits, which raised costs and created challenges for financing projects.

The Inflation Reduction Act also allows tax-exempt and governmental entities to receive elective payments for 12 clean energy tax credits, including the major Investment and Production Tax Credits, as well as tax credits for electric vehicles and charging stations. Businesses can also choose elective pay for a five-year period for three of those credits: the credits for Advanced Manufacturing (45X), Carbon Oxide Sequestration (45Q), and Clean Hydrogen (45V). Final rules on elective pay were issued in March.

To facilitate taxpayers transferring a clean energy credit or receiving a direct payment of an energy credit or CHIPS credit, the IRS built IRS Energy Credits Online (ECO) for taxpayers to complete the pre-file registration process and receive a registration number. The registration number must be included on the taxpayer’s annual return when making a transfer election or elective payment election for a clean energy credit. The registration process helps prevent improper payments to fraudulent actors and provides the IRS with basic information to ensure that any taxpayer that qualifies for these credit monetization mechanisms can readily access these benefits upon filing a return and making an election.

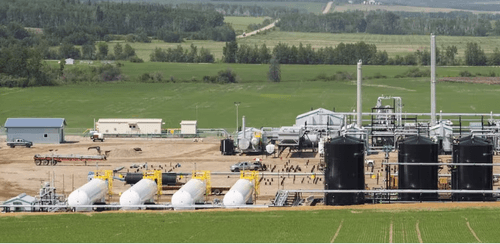

As of April 19, more than 900 entities have requested approximately 59,000 registration numbers for projects or facilities located across all 50 states plus territories. Approximately 97% of these projects are pursuing transferability. A wide variety of credits are being used, but the bulk transferability-related registrations are related to solar and wind projects using the investment or production tax credit. In addition, more than 1,300 projects or facilities submitted are pursuing elective pay, including submissions from more than 75 state and local governments to register approximately 650 clean buses and vehicles through elective pay.