Australia’s Woodside Energy is moving in a big way into the Gulf Coast markets for LNG and blue ammonia, with major project acquisitions of Tellurian and its Driftwood LNG project and OCI’s blue ammonia project in Beaumont, Texas.

The global operator is making a parallel play on present and future markets to solidify its position as an LNG powerhouse and jump to the front of the queue in new energy markets via blue ammonia.

Both acquisitions entail a measure of project risk, given their under-construction status and the lack of substantial offtake contracts. Woodside plans to mitigate these risks by leveraging its extensive customer relationships and its expertise in marketing and operations. Additionally, the company is exploring opportunities to farm down 50% of its Driftwood stake by 2025, having already attracted interest from potential investors.

The $900m purchase of Tellurian and Driftwood LNG gives Woodside a Gulf Coast project slated for FID readiness by early next year, with the possibility to expand from 11 MTPA in phase one and 5.5 MTPA in phase two to total permitted capacity of 27.6 MTPA.

Woodside is also acquiring OCI’s blue ammonia project, which is under construction in Beaumont, Texas, for $2.35bn. The project is scheduled to start producing ammonia in 2025 and aims to produce lower-carbon ammonia by 2026, utilizing carbon capture and storage (CCS) technology through an arrangement with ExxonMobil.

While the required outlay for the two projects is not likely to pressure Woodside’s balance sheet, “the lateral moves into U.S. LNG trading infrastructure and low-carbon ammonia and the potential cumulative development task add uncertainty to our investment thesis at the margin,” analysts from Morgan Stanley wrote in a published note this week.

Still, in investor calls, Woodside CEO Meg O’Neil expressed confidence that the company will meet its targeted 12% and 10% IRR for Driftwood LNG and ‘Texas Blue’, respectively – in part because of the synergies in the customer base for the two projects.

“In terms of customers, absolutely, I think [synergies are] one of the things that we really bring to the table and why OCI thought we were an interesting player to include in the process, is we’ve got very strong relationships with energy buyers, companies like Uniper, a number of different Japanese, Korean, Taiwanese buyers,” O’Neil said. “So, I think we’re able to open a different buyer universe, and with now the ability to point to low-carbon ammonia being available, we’ll be able to get our product into some different markets than might have been possible just as a conventional ammonia project.”

Driftwood IRR

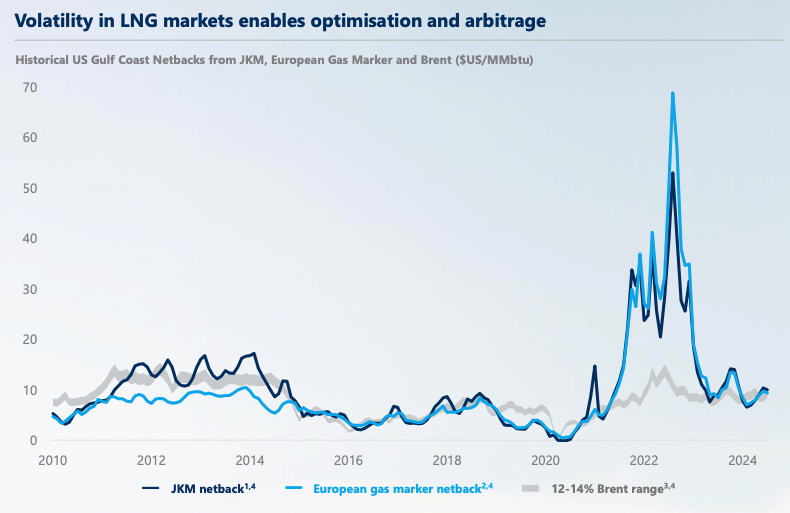

Woodside expects to utilize its deep customer relationships in the LNG space as well as an ability to arbitrage between three different LNG indices to boost the IRR on the Driftwood project to 12%, versus a typical infrastructure return of 8%. Tellurian had previously struggled to find offtakers for the project.

“I think we will be able to bring much of our marketing, shipping and trading expertise to offer a value uplift versus what a traditional infrastructure investment might look like,” O’Neil said. “Plus, on top of that, we’ve got our capability and development in operations and if you look at Pluto, for example” – a 4.9 MTPA LNG facility in Western Australia, in operations since 2012 – “the way we’ve been able to debottleneck that asset over the ten years of operations, I think we’ve got world-class capabilities that allows us to generate additional value versus many others in this space.”

Driftwood also offers diversification into the Atlantic Basin, opening up additional marketing and arbitrage potential, according to the company.

“As we think about selling this LNG we can sell on multiple different indices,” O’Neil said. “So much of the offtake from the U.S. now goes into Europe where it’s attracting TTF pricing. You can go the long way around to Asia where you can attract JKM pricing but we’ve also got the ability to contract against oil indexation.”

O’Neil emphasized Woodside’s competitive edge in avoiding traditional project finance specifications, which often require long-term offtake commitments. This flexibility allows Woodside to capitalize on growth in the LNG market, projected to expand by 50% over the next decade.

Ammonia price assumptions

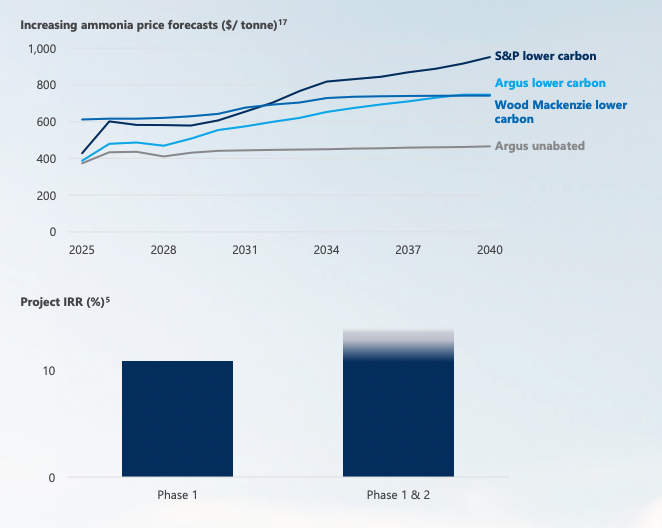

Woodside’s internal pricing models for blue ammonia are deliberately conservative compared to other market forecasts, according to O’Neil. The internal price projections would allow Woodside to achieve its 10% return on phase 1 of the project, and a higher return on the combined phase 1 and phase 2 portions due to the leveraging of common infrastructure.

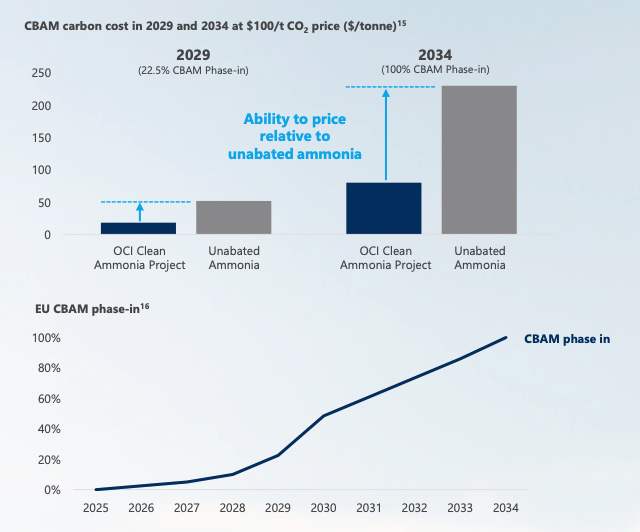

“You’ll note that the CBAM mechanism really doesn’t start kicking in until about 2029,” O’Neil said. “So again, our modeling shows modest price increase until that point in time, and then shows it phasing in stepwise to the full phase in 2034. So in aggregate, we think it’s a more conservative outlook than the third parties that are presented on that graph.”

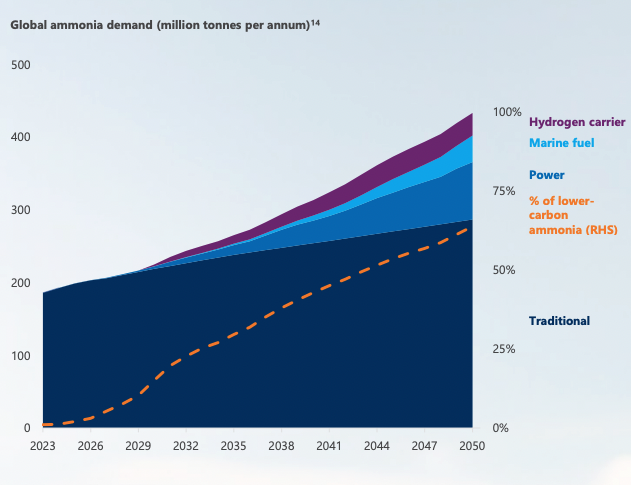

The demand for lower-carbon ammonia is expected to rise significantly, driven by decarbonization efforts across traditional sectors and emerging applications in power and marine fuels.

“The ammonia market is forecast to double by 2050, in part due to expected growth from traditional uses as the world’s population increases, but we also expect demand growth for lower carbon ammonia from new uses, including power generation, marine bunkering, and as a hydrogen carrier,” O’Neil said.

“Importantly, lower carbon ammonia is expected to make up two thirds of the market by 2050 as industries move to decarbonise and stricter regulations are implemented,” she added.

EU ETS price modeling

O’Neil highlighted that the company’s financial modeling used a conservative estimate of $80 per ton for the EU ETS (Emissions Trading System) price.

In a presentation filed with the news release, Woodside assumes $100 a ton for the EU ETS price, which determines the amount that importers must pay per ton of carbon embedded in imported products.

“Part of why we presented that at $100 a ton is to give you guys the tools to model that and make your own adjustments,” the executive said. “I think everybody’s aware that in house we use $80 a tonne. So again, for our internal modeling, it’s even a little bit more conservative than what’s presented there.”

Blue ammonia destination markets

The blue ammonia acquisition strategy considers the differing dynamics of EU and Asian markets, according to O’Neil. The EU is seen as a more predictable market overall due to the CBAM, which legislates a carbon price mechanism that imposes levies on carbon-intensive imports. This provides a clear incentive for using lower-carbon ammonia, making the EU a potentially more attractive market.

In Asia, the market is characterized by a contract-by-contract basis, O’Neil said, with countries like Japan and South Korea using supportive ‘contract for difference’ subsidy schemes. These schemes are designed to bridge the price gap between conventional fossil fuels and lower-carbon alternatives.

“I’m sure you’re well aware of the work that companies in places like Japan and Korea are doing to understand how to blend ammonia into coal-fired power stations to reduce emissions for the same power intensity,” O’Neil said. “We have run a range of economic cases just to get ourselves confident that even if there was a slower ramp-up of the premium pricing that it would still be a good investment for our shareholders.”

She continued, “Now in a world that moves aggressively to tackle climate change, there’s pricing upside, but I think we’ve been quite conservative in our modeling. As I said the pricing that we’ve assumed is somewhere between the unabated price and the three third-party forecasts for lower carbon pricing. We’ve been conservative in the carbon price that we use versus ETS today.

Just to be clear to everyone, the CBAM is law. So whilst there have been some policy changes in some jurisdictions around the world, the EU probably has quite a bit of form for staying the course when it comes to tackling climate change, and the CBAM is a method that’s – it’s a structure that’s been in place to ensure the competitiveness of European manufacturers. So I don’t see a whole lot of risk of that being phased out.”