WSP USA, an engineering, environment, and professional services consultancy, has successfully completed drilling operation and mechanical integrity tests for two new cavern wells for the Advanced Clean Energy Storage (ACES) I project in Utah — part of the first phase for the ACES Delta hydrogen hub, according to a news release.

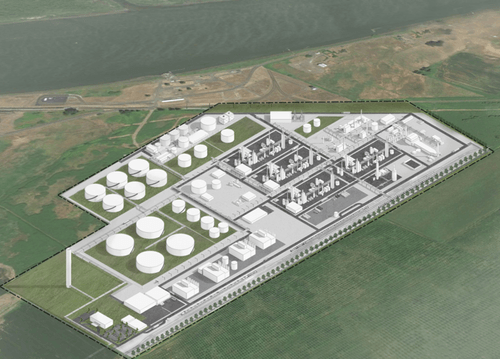

The Advanced Clean Energy Storage I project will convert renewable energy into green hydrogen that can be stored in utility-scale solution mined domal salt caverns. The ACES Delta hydrogen hub controls the only known “Gulf Coast”-style domal-quality salt formation in the western U.S., which contains five existing salt caverns already being used for storing liquid fuels.

Advanced Clean Energy Storage I is a wholly owned subsidiary of ACES Delta, LLC. ACES Delta is a joint venture between Magnum Development and Mitsubishi Power Americas.

WSP was contracted for the designing, drilling and completion of both cavern wells. Beside the drilling operation, WSP was responsible for designing procuring and managing the construction process of the project’s solution mining surface facility to provide water and power to the well sites and will manage the solution mining process until final completion of both caverns.

“Hydrogen underground storage is a key component of the hydrogen economy, which is critical in the effort to decarbonize U.S. power generation,” said Scyller Borglum, underground storage leader for WSP USA. “These underground salt dome caverns will provide a huge reservoir of renewable fuel for power generation, supporting levels of utility scale renewable energy storage that have not been previously possible.”

The drilling operation for each cavern well was completed ahead of schedule, and both cavern wells have successfully passed the mechanical integrity test designated to ensure well integrity prior to the start of the solution mining process.

Upon completion of the solution mining process, the total cavern volume of 9MM barrels-equivalent will be able to store around 300 gigawatt hours of clean and reliable energy in the form of hydrogen.

These will be the fourth and fifth hydrogen-compatible caverns in the U.S., and the salt cavern storage capacity will make it possible to store excess renewable energy produced in the spring when energy demand is low and use it to generate energy in the summer when demand is high.