Macquarie Asset Management (MAM) and Atlas Agro Holding AG (Atlas Agro) have announced today an up to $325m investment in Atlas Agro and affiliated project entities via the Macquarie GIG Energy Transition Solutions (MGETS) fund, according to a news release.

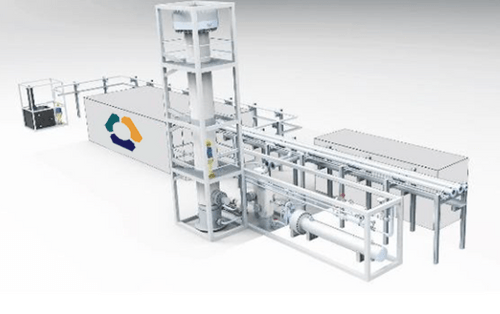

Atlas Agro is building industrial scale green nitrogen fertilizer plants in the United States and Latin America which will utilize green hydrogen in its production process, in lieu of conventional nitrogen fertilizer production utilizing fossil fuels. Atlas Agro’s innovative business model will produce competitive carbon-free nitrate fertilizers locally in agricultural regions, thereby displacing imported products with a significant carbon footprint from both production and transportation.

“MAM, with their experience in projects and infrastructure, ability to initiate support investments with a wide range of expertise and their commitment to accelerate decarbonization of hard-to-abate-industries, is an ideal partner for us as we approach construction of our first plants in the United States,” said Petter Østbø, CEO of Atlas Agro.

The investment is a significant step towards enabling Atlas Agro’s expansion across the Americas and globally. It will assist the company in realizing its vision of providing a sustainable alternative to conventional fossil-fuel based fertilizer products, which contribute heavily to greenhouse gas (GHG) emissions.

SpareBank 1 Markets AS acted as financial advisor and Homburger AG served as legal counsel to Atlas Agro. Allen & Overy LLP served as legal counsel to Macquarie Asset Management.