Climate Investment, the private equity firm with offices in London and Houston, is in the middle of raising a second fund up to $1bn, according to two sources familiar with the matter.

SocGen is assisting on the fundraise, which is scheduled to wrap up in 1Q24, the sources said.

Climate Investment has to date been making investments in early-stage companies. The second fund will be dedicated to more mature investment opportunities, one of the sources said.

The firm is in discussions with new LPs and is deliberately targeting strategics who can provide vertical integration capabilities and offtake, the same source said.

Representatives of Climate Investment declined to comment. SocGen did not respond to a request for comment.

Climate Investment was founded in 2016 by members of the Oil & Gas Climate Initiative (OGCI), who announced an investment of $1bn over ten years at the time. Since then the firm has made dozens of investments spanning transportation, infrastructure technology, renewable fuels and carbon capture.

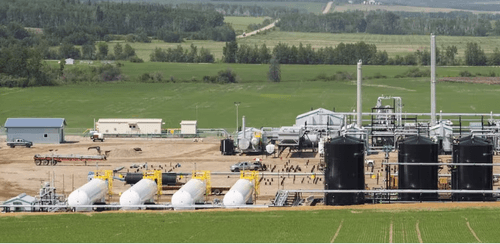

The firm’s fuel investments include the UK and Oman-based company F2V (Flare to Value), Next Decade’s Rio Grande LNG project, Utah-based methane solutions firm Qnergy, and Texas natural gas CCS firm QuailRun Carbon, among others.