Mingo County, West Virginia – deep Appalachian coal country on the border with Kentucky and Virginia – in recent years the subject of highbrow news analyses on poverty, food insecurity, and social disaffection, now the site of what would be the largest ammonia production facility in the world.

TransGas Development Systems, the New York-based affiliate of Gas Alternatives Systems, has been issued a draft Permit to Construct for the Adams Fork Energy nitrogen fertilizer production facility on a former coal mining site near Wharncliffe by the state Department of Environmental Protection. The project includes plans to capture and sequester carbon dioxide in the production process.

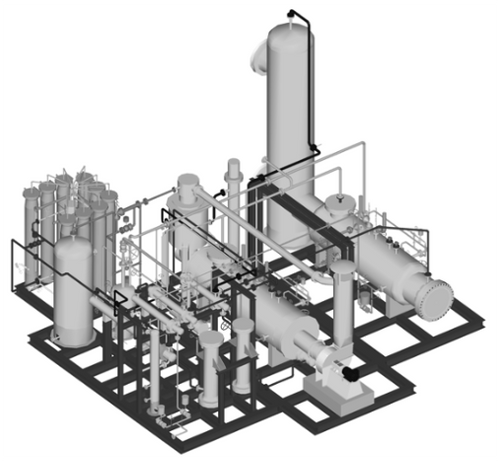

An engineering evaluation describes six identical 6,000 mtpd ammonia manufacturing plants on the site of a previously permitted (but not constructed) coal-to-gasoline facility for which TransGas first applied in 2010.

At more than 13 million mtpy, the combined production would far outstrip the Donaldsonville (Louisiana) Complex of CF Industries, the largest ammonia facility in the world to date. CF says that facility has 4.3 million tons of ammonia production capacity but produces 8 million tons of nitrogen products.

The Flandreau Santee Sioux Tribe of South Dakota have publicly urged the federal government to back the project. The tribe is jointly developing the project with Adams Fork Energy, LLC, which was previously an anchor project in the successful ARCH2 application to the US Department of Energy.